McKelvey — one-time employer and longtime friend of Dorsey, a

“I said to Jack, we should solve this problem,”

McKelvey said. “It began with a lost sale and the frustration of a

small merchant.”

Nine months later, the two partners revealed their

proposed solution to a tech community thirsting to know the next move

by the man whose microblogging service, Twitter, changed the way people

connect and share information.

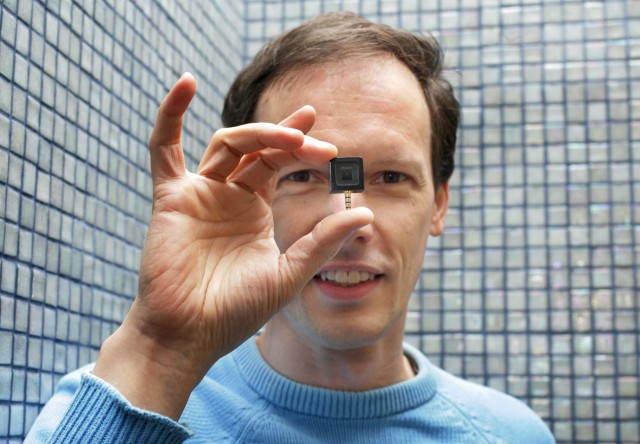

At its heart, Square is rather simple. It’s a small

plastic device, or dongle, that plugs into a cell phone’s audio jack

and allows anyone, including small merchants and individuals, to accept

credit card payments. The credit card owner uses a finger to sign a

receipt on the phone’s touch screen.

In some ways, it’s a pronounced change from the

status quo that requires every business that accepts credit cards to

have its own merchant account — a type of bank account used to process

payments. Often, small-business owners don’t have them because they’re

expensive.

But now Square says smaller businesses and

individuals will be able to piggyback on its merchant account, opening

the world of credit card sales to people and businesses locked out by

current restrictions.

The idea of such a thing has left many in the

financial services sector scratching their heads — and in some cases,

rolling their eyes — at Dorsey’s upstart company, which will have

offices in

They also want to know how much it will cost to use

the service. It’s expected that each transaction will include some sort

of fee to pay for Square’s operations, as well as the fee — typically 2

percent to 3 percent — charged credit card companies.

The uncertainties surrounding Square have left analysts like

“It’s largely just hype at this point,” McPherson said. “I wouldn’t put too much stock in it.”

Not everyone agrees, however. Square’s first round of venture capital funding valued the company at

Some of the mystery surrounding Square can be traced

to Dorsey and the way Twitter has grown. Much of that company’s success

— there’s even talk now that it will be profitable this year after

signing search deals with

Consider the recent addition of a “retweet button”

allowing users to quickly rebroadcast other users’ updates. It simply

made it easier for people to do something they were already doing.

McKelvey suggests a similar path for Square, now in early testing with some 300 merchants in

“We don’t know where this is going. If done right, the market will tell us what the uses are,” he said.

For now, the company expects to go after businesses

not big enough to have their own merchant accounts. That means they

don’t expect to take much business from competitors. But McKelvey said

they’ve had inquiries from clothing retailers interested in a system

that would let employees do checkouts anywhere in a store.

There’s also the possibility Square could prove popular for transactions between people making deals on

Still months away from an expected launch during the

first quarter of 2010, the company already has its share of critics.

Some wonder if there’s a viable market for what Square is offering.

“He’s really going after the bottom-of-the-barrel merchants,” said

Kleitsch and others have been quick to point out

that Square offers little that’s new. Several companies already have

mobile payment systems, some using specialized devices and others using

cell phones. The key difference is that everyone else requires a

merchant account.

That includes a new mobile device expected to hit

the market just ahead of Square. PAYware Mobile also uses a card reader

that attaches to a cell phone and targets lower-volume businesses. A

key difference is that PAYware is made by

“We’re pretty much ready to go to market,” Rasori said. “This is the real deal.”

That Square already has a strong competitor

illustrates one potential problem for the young company. If successful,

it’s going to be vulnerable to competition, said Sherif Nasser,

assistant professor of marketing at

The thing that makes PayPal, an online payment

system, successful has been its ability to create a large base of

connected users — you can only do business through PayPal if both of

you have an account.

But Square won’t have that same captive audience,

Nasser said. Credit card users aren’t obligated to use any particular

payment system. There’s nothing stopping a larger company from creating

serious problems for Square.

“If I were Apple or

And, as it turns out, it wouldn’t be all that hard

for someone to build a system remarkably similar to Square. That’s

because the man who helped create the card reader had a falling out

with Dorsey and McKelvey.

worked with the pair earlier this year and has applied for a patent on

the device. But after months of negotiations over compensation failed,

they basically agreed to go their separate ways, with Square saying it

would use something different for card reading.

The professor says he has no ill feelings toward

Square: “I just want to get my story out there. It’s actually my idea

and it’s for sale.”

—

(c) 2009, St. Louis Post-Dispatch.

Visit the

Distributed by McClatchy-Tribune Information Services.