As CEO of JPMorgan Chase, this ruling mogul of Wall Street must now cope with the recently enacted financial reform bill, which imposes a host of new regulations meant to rein in the rip-offs, frauds and other excesses of Wall Street bankers.

Republican lawmakers, however, are crying that the Democrats’ reform bill puts a crushing burden on the poor financial giants. While these Wall Street apologists wail and keen, though, slick operators like Dimon are wasting no time on tears. Instead, they’re devising ways to slip out of the new regulatory reins. For example, the law limits the outrageous overdraft fees that banks have been sneaking onto our debit card accounts. No problem — the giants are quietly imposing new “maintenance fees” for basic checking accounts. Forget receiving a free toaster for opening an account, banks now hit you with up to $15 a month just for the privilege of putting your money in their bank.

Dimon insists that this is necessary: “If you’re a restaurant and you can’t charge for the soda, you’re going to charge more for the burger,” he lectures.

Come on, Jamie, drop the mom-and-pop pose.

You’re not a little restaurant struggling to make ends meet — you head a monopolistic financial behemoth that helped ruin the economy for America’s moms & pops, then took billions in taxpayer bailouts, used the crisis to increase its monopoly power, continues to get federally subsidized money, just announced a 78-percent hike in profits, and recently paid you a salary and bonus of $18 million.

The Dimons of Wall Street keep picking our pockets because they believe they’re entitled to excessive profits and paychecks. To help bring these greedheads down to Earth, visit Americans for Financial Reform: www.ourfinancialsecurity.org.

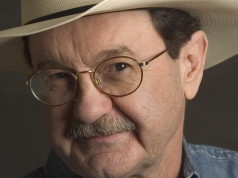

JimHightower.com

For

more information on Jim Hightower’s work — and to subscribe to his

award-winning monthly newsletter, The Hightower Lowdown — visit www.jimhightower.com.