America has the wrong approach for dealing with thieves. Rather than “looking backwards” at their misdeeds and “punishing” them, we merely need to ask that they not misbehave in the future, then monitor their behavior.

Believe it or not, this is how congressional leaders are addressing the thievery of three little-known gangs. Congress’ compassionate approach is not meant for common robbers, of course. No, no — lawmakers are happy to punish them to the hilt. Rather, the kid-glove treatment is reserved for thieves named Moody’s, Standard & Poor’s and Fitch’s — the Big Three credit rating agencies that exist to evaluate the worthiness of corporate issued bonds, assigning a grade (from triple-A to “junk”) that helps investors know the risk involved in buying the bonds.

But the Big Three run a rigged game that robs our pension funds and other investors. Moody’s, S&P and Fitch are not independent public regulators, but for-profit firms that are paid fat fees by the very corporations whose bonds they rate. Yes, this is an inherent conflict of interest! It allows rating firms to profit by merrily putting smiley-faced grades on lousy bonds, thus deceiving (and robbing) the public. For example, the Big Three gave thumbsup to the subprime housing bonds that turned out to be worthless, leading to trillions of dollars in losses for the public and crashing our economy.

Yet, our soft-on-corporate-crime Congress critters have declared these finaglers “too big to jail.” Rather than taking the Big Three off the street, Congress is coddling them, meekly freeing them to continue their corrupt, forhire, monopolistic system of credit-rating flim-flammery.

The important financial responsibility of grading corporate bonds should be done by a public entity whose sole loyalty is to the public — not to the corporations whose bonds are being rated.

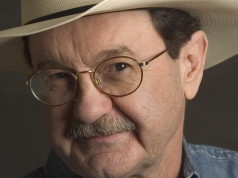

jimhightower.com For more information on Jim Hightower’s work — and to subscribe to his award-winning monthly newsletter, The Hightower Lowdown — visit www.jimhightower.com.