At the recent World Economic Forum meeting in Davos, teenage climate activist Greta Thunberg told the uber-rich that they should abandon their fossil fuel investments. Trump’s Treasury Secretary Steven Mnuchin said she should go to college “to study economics” before “she can come back and explain that to us.”

This provoked Yanis Varoufakis, economist and a former finance minister of Greece, to sarcastically remark that if Thunberg studied mainstream economics, she would learn that “neither a climate disaster nor an economic crisis is possible.” He said mainstream economics textbooks offer “models of markets where the unfettered private profit drive is shown mathematically to serve the public interest.”

Actually Mnuchin could teach a course on how to wipe out the wealth of millions of American families and get the taxpayers to pay you to do it. That’s what you conclude after reading Aaron Glantz’s impressive book, Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American Dream.

Glantz is senior reporter at Reveal from the Center for Investigative Reporting, a two-time Peabody Award winner and finalist for the Pulitzer Prize.

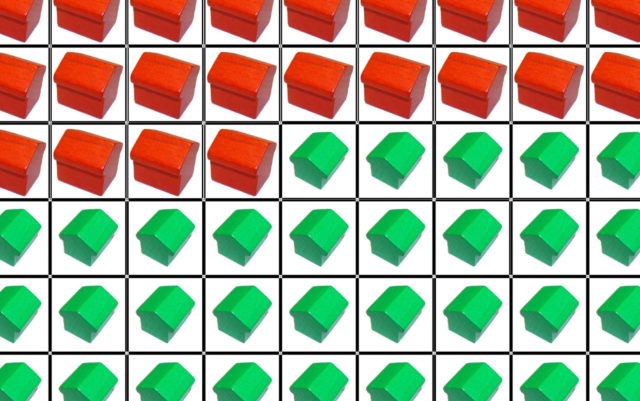

Mnuchin is a major villain in Homewreckers. The book reveals how members of Donald Trump’s inner circle took advantage of the 2008 housing crash to enrich themselves. There was a “recovery” of sorts where large private equity firms bought up hundreds of thousands of foreclosed homes and turned them into rental properties.

The culprits in this scheme included Trump pals such as Mnuchin, Commerce Secretary Wilbur Ross, Trump’s longtime friend and confidant Tom Barrack, and billionaire Republican donor Steve Schwarzman.

Glantz writes that now these vulture capitalists of Wall Street have powerful positions in the federal government and “are creating new financial products that threaten to make the wealth transfers of the [housing] bust permanent.”

Glantz was inspired to write the book when he heard that 8 million Americans had lost their homes in the Great Recession. He wondered what happened to those houses and who profited? He found that the mess was the result of decisions over decades by both Republican and Democratic administrations. The home ownership rate declined every year of the Obama administration.

Beginning in the 1970s, there was a bipartisan push to restructure the financial sector and unleash credit. The federal government loosened regulations on savings and loan associations and banks.

With the encouragement of both the Bill Clinton and George W. Bush administrations, the home finance industry engaged in the largest promotion of homeownership in decades. Lenders pushed high-interest and risky mortgages on people who wanted to own homes. There was quite a lot of fraud and deception going on. There were the so-called NINJA loans (no income, no job, no assets, no problem). Mortgage lenders encouraged speculation and housing developers overbuilt.

Bad loans came due and there were massive foreclosures. We taxpayers subsidized the foreclosures.

IndyMac in Pasadena, California, was the first major bank to collapse. Steve Mnuchin and his group of other investors (which included George Soros, John Paulson, Michael Dell, the founder of Dell Computer) foreclosed on over 100,000 families, including 23,000 seniors. Under the deal that he made with the government to acquire this bank (which the government owned because it failed) he and his investors paid the government absolutely nothing.

He did invest some of his own money in the bank but we taxpayers then paid him to subsidize his foreclosures. His group received more than $1 billion from us, according to documents Glantz obtained under the Freedom of Information Act. Wilbur Ross had a similar deal at a failed bank in Florida called BankUnited.

Glantz says that when Obama took office, there were influential people who said that there was a different way to deal with the economic crisis. The Democrats controlled the presidency and both houses of Congress. Some prominent economists argued Obama should act like Franklin Roosevelt.

During the Great Depression, FDR established a new government-run bank called the Home Owners’ Loan Corporation. It refinanced one out of every five home loans in urban America. It saved a million people’s homes, and the government made money because people paid back the loans.

Obama didn’t become another FDR. The people who made the decisions told Glantz that they were feeling “the pressure of time” and didn’t think they could do bold things. They were afraid the country was on the brink of another Great Depression. Now, Glantz told an interviewer, “the people who looted us during the Obama years are now running the country.” He said the Trump gang is “bit by bit, taking away the few scraps and reforms that Obama put in place, defanging the Consumer Financial Protection Bureau, weakening the Dodd-Frank Act, which regulated the banks.”

Despite all of this, Glantz told an interviewer that he is quite hopeful. Housing justice has become an issue in the Democratic primaries. Presidential candidates have been proposing bold national action, particularly Bernie Sanders and Elizabeth Warren.

This opinion column does not necessarily reflect the views of Boulder Weekly.