Perhaps you’ve been wondering:

How’s Ben doing?

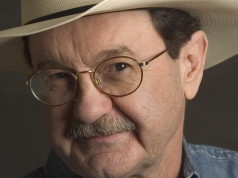

Extremely well — thank you, now that he has stepped down as head of the Fed. Federal Reserve Chairman Ben Bernanke presided over most of the 2008 financial crash, the Wall Street bailout, the Great Recession, and today’s so-called “recovery-that-isn’t,” since 90 percent of Americans still have not recovered.

So what’s Ben been doing now that he’s no longer saving banksters with U.S. taxpayers’ dollars? Going to bankster gatherings to bask in their glowing gratitude — and collecting his cut of the bailout loot.

In one week in May, Bernanke was in Abu Dhabi on Tuesday, Johannesburg on Wednesday and Houston on Friday, speechifying to global bankers and hobnobbing with hedge fund billionaires and economic titans. Each of these private chats put $200,000 or more into Ben’s pockets. He’s doing beaucoup of these cash-on-the-barrelhead BenFests for the likes of JPMorgan Chase, Blackstone Group and Morgan Stanley. In conferences and in small dinners at four-star restaurants, Bernanke is offering “words of wisdom” to barons of high finance he bailed out, in exchange for a ridiculous fee that most could not have paid without those rescue funds that the Fed chief extracted from you and me.

But here’s an irony that’s gotta be chapping Ben’s butt — some of the banksters he saved are refusing to play the payback game. Not because they’re bothered by the totally corrupt ethics involved, but because they’re balking at his high fees. Goldman Sachs, for example, which got a $10 billion bailout and whose CEO took $23 million in personal pay last year, says Bernanke’s $200,000 tab is too steep.

Is there no honor among thieves?

What’s this world coming to when the robber barons won’t toss a couple of hundred thousand bailout crumbs to Ben, their loyal servant?

This opinion column does not necessarily reflect the views of Boulder Weekly.

Respond: [email protected]